The Initial IPO

On this date, May 17, in 1792, twenty-four merchants and stockbrokers met under a buttonwood tree on Wall Street. They signed a document, known as the Buttonwood Agreement, pledging to trade securities only with each other. This was the origin of the New York Stock Exchange.

Signing the Buttonwood Agreement

The signers of the Buttonwood Agreement traded only a few securities initially. The first corporate stock was the Bank of New York. Alexander Hamilton had founded this bank in 1784. It is the oldest continuously operating bank in the United States, although it is now known as the Bank of New York Mellon.

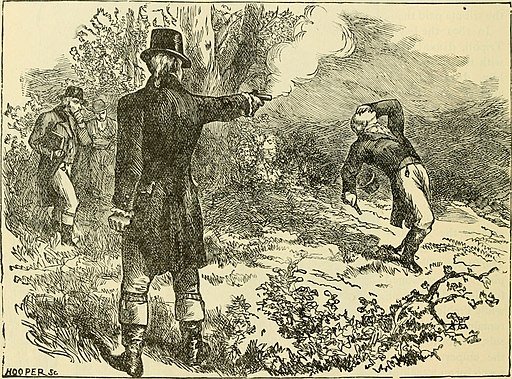

Several years after going public, the Bank of New York moved into a building on Wall Street. It was the first bank to do so, setting the stage for the many other financial institutions that would soon follow. One of the them was the Bank of the Manhattan Company, founded by Hamilton’s arch-competitor and future killer Aaron Burr. That bank also operates now under a different name: Chase Manhattan.

Duel between Alexander Hamilton and Aaron Burr

Initial public offerings are still newsworthy events. In this century, the U.S. stock market has had about 100 to 300 IPOs each year. Despite the pandemic, 2021 was a banner year for IPOs, with 1,035 such events.